Consumer Choice and Intertemporal Choice¶

We setup and solve a very simple generic one-period consumer choice problem over two goods. We later specialize to the case of intertemporal trade over two periods and choice over lotteries. The consumer is assumed to have time-consistent preofereces. Later, in a separate notebook, we look at a a three period model where consumers have time-inconsistent (quasi-hyperbolic) preferences.

The code to generate the static and interactive figures is at the end of this notebook (and should be run first to make this interactive).

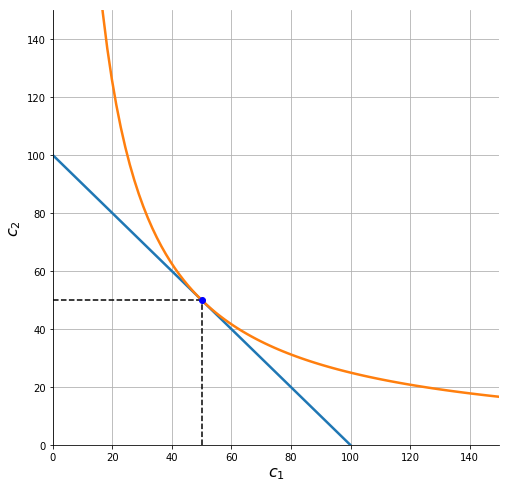

Choice over two goods¶

A consumer chooses a consumption bundle to maximize Cobb-Douglas utility

subject to the budget constraint

To plot the budget constraint we rearrange to get:

Likewise, to draw the indifference curve defined by \(u(c_1,c_2) = \bar u\) we solve for \(c_2\) to get:

For Cobb-Douglas utility the marginal rate of substitution (MRS) between \(c_2\) and \(c_1\) is:

where \(U_1 =\frac{\partial U}{\partial c_1}\) and \(U_2 =\frac{\partial U}{\partial c_2}\)

In [17]:

consume_plot()

The consumer’s optimum¶

Differentiate with respect to \(c_1\) and \(c_2\) and \(\lambda\) to get:

Dividing the first equation by the second we get the familiar necessary tangency condition for an interior optimum:

Using our earlier expression for the MRS of a Cobb-Douglas indifference curve, substituting this into the budget constraint and rearranging then allows us to solve for the Marshallian demand functions:

Interactive plot with sliders (visible if if running on a notebook server):

In [20]:

interact(consume_plot,p1=(pmin,pmax,0.1),p2=(pmin,pmax,0.1), I=(Imin,Imax,10),alpha=(0.05,0.95,0.05));

The expenditure function¶

The indirect utility function:

To minimize expenditure needed to achieve level of utility \(\bar u\) we solve:

s.t.

The first order conditions are identical to those we got for the utility maximization problem, and hence we have the same tangency

From this we can solve:

Now substitute this into the constraint to get:

Intertemporal Consumption choices¶

We now look at the special case of intertemporal consumption, or consumption of the same good (say corn) over two periods. As modeled below the consumer’s income is now given by the market value of and endowment bundle \((y_1,y_2)\).

The variables \(c_1\) and \(c_2\) now refer to consumption of (say corn) in period 1 and period 2.

As is typical of intertemporal maximization problems we will use a time-additive utility function. The consumer who has access to a competitive financial market (they can borrow or save at interest rate \(r\)) maximizes:

subject to the intertemporal budget constraint:

This is just like an ordinary utility maximization problem with prices \(p_1 = 1\) and \(p_2 =\frac{1}{1+r}\). Think of it this way, the price of corn is $1 per unit in each period, but $1 in period 1 can be placed into savings that will grow to \((1+r)\) dollars in period 2. That means that from the standpoint of period 1 owning one unit of corn (or one dollar worth of corn) in period 2 is the equivalent of owning \(\frac{1}{1+r}\) units of corn today (because placed in savings that amount of period 1 corn would grow to \(\frac{1+r}{1+r} = 1\) units of corn in period 2).

The first order necessary condition for an interior optimum is:

Let’s adopt the widely used Constant-Relative Risk Aversion (CRRA) felicity function of the form:

The first order condition then becomes simply

or

From the binding budget constraint we also have

where \(E[y] = y_1 + \frac{y_2}{1+r}\)

Solving for \(c_1^*\) (from the FOC and this binding budget):

If we simplify to the simple case where \(\delta =\frac{1}{1+r}\), where the consumer discounts future consumption at the same rate as the market interest rate then at an optimum the consumer will keep their consumption flat at \(c_2^* = c_1^*\). If we specialize further and assume that \(r=0\) then the consumer will set \(c_2^* = c_1^* =\frac{y_1+y_2}{2}\)

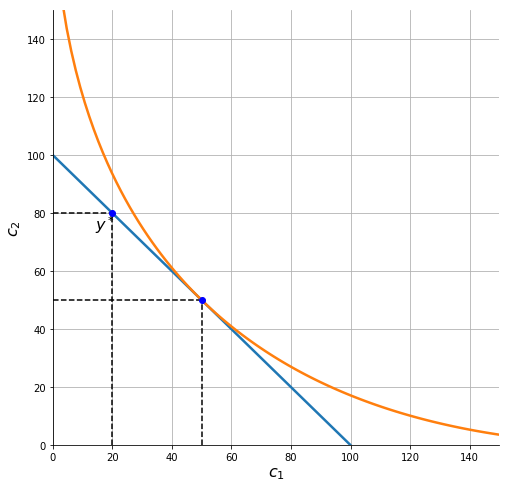

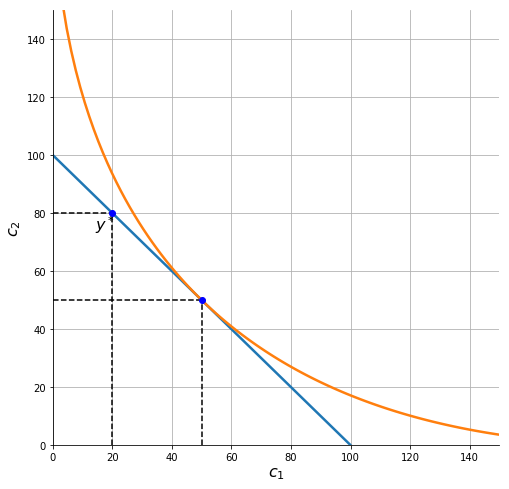

Saving and borrowing visualized¶

Let us visualize the situation. The consumer has CRRA preferences as described above (summarized by parameters \(\delta\) and \(\rho\) and starts with an income endowment \((y_1, y_2)\). The market cost of funds is \(r\).

A savings case¶

In the diagram below the consumer is seen to be saving, i.e. \(s_1^* = y_1 - c_1^* >0\).

In [23]:

consume_plot2(r, delta, rho, y1, y2)

Interactive plot with sliders (visible if if running on a notebook server):

In [21]:

interact(consume_plot2, r=(rmin,rmax,0.1), rho=fixed(rho), delta=(0.5,1,0.1), y1=(10,100,1), y2=(10,100,1));

In [12]:

c1e, c2e, uebar = find_opt2(r, rho, delta, y1, y2)

In this particular case the consumer consumes:

In [13]:

c1e, c2e

Out[13]:

(50.0, 50.0)

Her endowment is

In [14]:

y1,y2

Out[14]:

(80, 20)

And she therefore saves

In [15]:

y1-c1e

Out[15]:

30.0

in period 1.

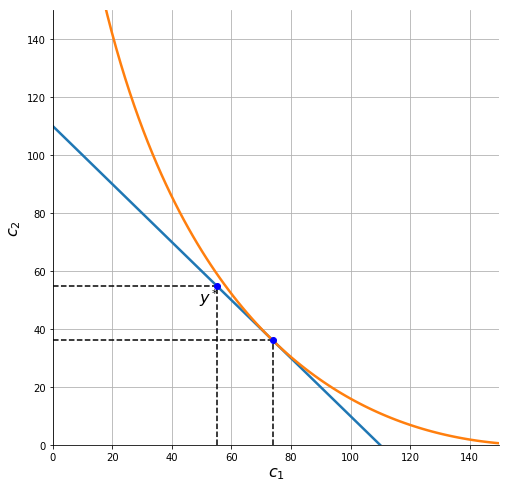

A borrowing case¶

In the diagram below the consumer is seen to be borrowing, i.e. \(s_1^* = y_1 - c_1^* <0\).

In [16]:

y1,y2 = 20,80

consume_plot2(r, delta, rho, y1, y2)

## Code section Run the code below first to re-generate the figures and

interactions above.

In [1]:

%matplotlib inline

import numpy as np

import matplotlib.pyplot as plt

from ipywidgets import interact, fixed

Code for simple consumer choice¶

In [2]:

def U(c1, c2, alpha):

return (c1**alpha)*(c2**(1-alpha))

def budgetc(c1, p1, p2, I):

return (I/p2)-(p1/p2)*c1

def indif(c1, ubar, alpha):

return (ubar/(c1**alpha))**(1/(1-alpha))

In [3]:

def find_opt(p1,p2,I,alpha):

c1 = alpha * I/p1

c2 = (1-alpha)*I/p2

u = U(c1,c2,alpha)

return c1, c2, u

Parameters for default plot

In [4]:

alpha = 0.5

p1, p2 = 1, 1

I = 100

pmin, pmax = 1, 4

Imin, Imax = 10, 200

cmax = (3/4)*Imax/pmin

In [5]:

def consume_plot(p1=p1, p2=p2, I=I, alpha=alpha):

c1 = np.linspace(0.1,cmax,num=100)

c1e, c2e, uebar = find_opt(p1, p2 ,I, alpha)

idfc = indif(c1, uebar, alpha)

budg = budgetc(c1, p1, p2, I)

fig, ax = plt.subplots(figsize=(8,8))

ax.plot(c1, budg, lw=2.5)

ax.plot(c1, idfc, lw=2.5)

ax.vlines(c1e,0,c2e, linestyles="dashed")

ax.hlines(c2e,0,c1e, linestyles="dashed")

ax.plot(c1e,c2e,'ob')

ax.set_xlim(0, cmax)

ax.set_ylim(0, cmax)

ax.set_xlabel(r'$c_1$', fontsize=16)

ax.set_ylabel('$c_2$', fontsize=16)

ax.spines['right'].set_visible(False)

ax.spines['top'].set_visible(False)

ax.grid()

plt.show()

Code for intertemporal Choice model¶

In [6]:

def u(c, rho):

return (1/rho)* c**(1-rho)

def U2(c1, c2, rho, delta):

return u(c1, rho) + delta*u(c2, rho)

def budget2(c1, r, y1, y2):

Ey = y1 + y2/(1+r)

return Ey*(1+r) - c1*(1+r)

def indif2(c1, ubar, rho, delta):

return ( ((1-rho)/delta)*(ubar - u(c1, rho)) )**(1/(1-rho))

In [7]:

def find_opt2(r, rho, delta, y1, y2):

Ey = y1 + y2/(1+r)

A = (delta*(1+r))**(1/rho)

c1 = Ey/(1+A/(1+r))

c2 = c1*A

u = U2(c1, c2, rho, delta)

return c1, c2, u

Parameters for default plot

In [8]:

rho = 0.5

delta = 1

r = 0

y1, y2 = 80, 20

rmin, rmax = 0, 1

cmax = 150

In [9]:

def consume_plot2(r, delta, rho, y1, y2):

c1 = np.linspace(0.1,cmax,num=100)

c1e, c2e, uebar = find_opt2(r, rho, delta, y1, y2)

idfc = indif2(c1, uebar, rho, delta)

budg = budget2(c1, r, y1, y2)

fig, ax = plt.subplots(figsize=(8,8))

ax.plot(c1, budg, lw=2.5)

ax.plot(c1, idfc, lw=2.5)

ax.vlines(c1e,0,c2e, linestyles="dashed")

ax.hlines(c2e,0,c1e, linestyles="dashed")

ax.plot(c1e,c2e,'ob')

ax.vlines(y1,0,y2, linestyles="dashed")

ax.hlines(y2,0,y1, linestyles="dashed")

ax.plot(y1,y2,'ob')

ax.text(y1-6,y2-6,r'$y^*$',fontsize=16)

ax.set_xlim(0, cmax)

ax.set_ylim(0, cmax)

ax.set_xlabel(r'$c_1$', fontsize=16)

ax.set_ylabel('$c_2$', fontsize=16)

ax.spines['right'].set_visible(False)

ax.spines['top'].set_visible(False)

ax.grid()

plt.show()

Interactive plot¶

In [19]:

interact(consume_plot2, r=(rmin,rmax,0.1), rho=fixed(rho), delta=(0.5,1,0.1), y1=(10,100,1), y2=(10,100,1));

In [ ]: